Day Return

YTD Return

1-Year Return

3-Year Return

5-Year Return

Note: Sector performance is calculated based on the previous closing price of all sector constituents

Industries in This Sector

Select an Industry for a Visual Breakdown

| Industry | Market Weight | YTD Return | |

|---|---|---|---|

| All Industries | 100.00% | 3.95% | |

| Drug Manufacturers - General | 34.16% | 9.97% | |

| Healthcare Plans | 13.22% | -4.20% | |

| Medical Devices | 12.79% | 4.62% | |

| Biotechnology | 11.44% | -3.09% | |

| Diagnostics & Research | 11.41% | 3.77% | |

| Medical Instruments & Supplies | 6.62% | 3.87% | |

| Medical Care Facilities | 2.95% | 13.10% | |

| Drug Manufacturers - Specialty & Generic | 2.77% | -3.95% | |

| Medical Distribution | 2.35% | 8.97% | |

| Health Information Services | 2.08% | 6.25% | |

| Pharmaceutical Retailers | 0.23% | -33.54% | |

Note: Percentage % data on heatmap indicates Day Return

All Industries

-

Largest Companies in This Sector

Name | Last Price | 1Y Target Est. | Market Weight | Market Cap | Day Change % | YTD Return | Avg. Analyst Rating |

|---|---|---|---|---|---|---|---|

| 771.55 | 854.53 | 11.33% | Buy | ||||

| 507.03 | 566.61 | 7.21% | Buy | ||||

| 149.85 | 160.66 | 5.57% | Buy | ||||

| 130.23 | 131.55 | 5.10% | Buy | ||||

| 160.40 | 182.41 | 4.38% | Buy | ||||

| 577.93 | 622.29 | 3.41% | Buy | ||||

| 251.43 | 252.44 | 2.88% | Buy | ||||

| 104.67 | 126.23 | 2.81% | Buy | ||||

| 312.86 | 293.92 | 2.59% | Buy | ||||

| 28.18 | 29.18 | 2.47% | Buy |

Investing in the Healthcare Sector

Start Investing in the Healthcare Sector Through These ETFs and Mutual Funds

ETF Opportunities

Name | Last Price | Net Assets | Expense Ratio | YTD Return |

|---|---|---|---|---|

| 143.30 | 37.936B | 0.09% | ||

| 262.05 | 20.002B | 0.10% | ||

| 133.42 | 6.991B | 0.45% | ||

| 88.98 | 6.358B | 0.35% | ||

| 55.85 | 5.241B | 0.40% |

Mutual Fund Opportunities

Name | Last Price | Net Assets | Expense Ratio | YTD Return |

|---|---|---|---|---|

| 212.83 | 45.706B | 0.29% | ||

| 89.74 | 45.706B | 0.29% | ||

| 131.08 | 20.002B | 0.10% | ||

| 92.74 | 15.399B | 0.80% | ||

| 92.92 | 14.487B | 0.80% |

Healthcare Research

Discover the Latest Analyst and Technical Research for This Sector

Analyst Report: Cronos Group Inc.

Cronos Group, headquartered in Toronto, Canada, cultivates and sells medicinal and recreational cannabis through its medicinal brand, Peace Naturals, and its two recreational brands, Cove and Spinach. Although it primarily operates in Canada, Cronos exports medical cannabis primarily to Israel. In the U.S. the company has an option to acquire 10.5% of U.S. multistate operator PharmaCann upon easing of federal prohibition.

RatingPrice TargetAnalyst Report: Myriad Genetics, Inc.

Myriad Genetics is a molecular diagnostics company that provides testing services designed to assess an individual’s risk of developing a disease. The firm produces MyRisk, a 48-gene panel with the capability to identify the elevated risk of developing 11 types of cancer. Other diagnostic products include BRACAnalysis CDx, the FDA-approved companion diagnostic for PARP inhibitors; GeneSight, which helps improve responses to psychotropic drugs for patients suffering from depression; and Prequel, a noninvasive prenatal test. Precise Oncology Solutions, launched in 2022, combines Precise Tumor with companion diagnostic and prognostic tests such as MyChoice CDx, Prolaris, and EndoPredict. The firm offers biomarker discovery and companion diagnostic services to pharma and biotech companies.

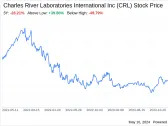

RatingPrice TargetAnalyst Report: Charles River Laboratories International, Inc.

Charles River Laboratories was founded in 1947 and is a leading provider of drug discovery and development services. The company’s research model & services segment is the leading provider of animal models for laboratory testing, which breeds and delivers animal research models with specific genetic characteristics for preclinical studies around the world. The discovery & safety assessment segment includes services required to take a drug through the early development process, including discovery services. The manufacturing support segment includes microbial solutions, which provides in vitro (non-animal) testing products, biologics testing services, and avian vaccine services.

RatingPrice TargetAnalyst Report: Royalty Pharma plc

Royalty Pharma PLC is the largest buyer of biopharmaceutical royalties. The firm has a portfolio of royalties that entitles it to payments based on the sales of biopharma products. Royalty Pharma receives royalties on more than 35 commercial products, including AbbVie and Johnson & Johnson's Imbruvica (for chronic lymphocytic leukemia and other blood cancers), Biogen's Tysabri (for relapsing forms of multiple sclerosis), Vertex's cystic fibrosis franchise, and 10 development-stage product candidates.

RatingPrice Target